Beijing BDStar Navigation Bundle

How Does Beijing BDStar Navigate Its Sales and Marketing?

Founded in 2000, Beijing BDStar Navigation Co., Ltd. has become a key player in the Global Navigation Satellite System (GNSS) applications market. From its roots in satellite navigation products, BDStar has expanded into location-based services, driven by high-integration chip design and high-precision GNSS core products, especially focusing on BeiDou. This strategic evolution highlights the company's dynamic approach within the competitive Chinese market.

This analysis delves into the Beijing BDStar Navigation SWOT Analysis, exploring its BDStar sales strategy, and BDStar marketing strategy within the context of its GNSS technology offerings. We'll examine how BDStar has cultivated its BDStar product portfolio, managed BDStar distribution channels, and implemented BDStar marketing campaigns to enhance BDStar brand awareness and drive growth. Understanding these elements is crucial for investors and strategists looking to assess the Navigation company's position, considering its BDStar market share analysis, and its strategies for BDStar customer acquisition and BDStar customer retention in a rapidly evolving landscape.

How Does Beijing BDStar Navigation Reach Its Customers?

The sales and marketing strategy of Beijing BDStar Navigation leverages a multifaceted approach, focusing on direct sales, strategic partnerships, and a strong presence in both domestic and international markets. The company's sales channels are primarily structured around its three key business segments: GNSS Chips & Data Services, GNSS Antennas, and Ceramic Components. This strategy is critical for a navigation company operating in a competitive landscape.

Direct sales teams are likely crucial for engaging with large industrial clients, government entities, and military applications, where customized solutions and technical support are essential. This approach is particularly relevant given their significant market share in areas like mechanical control for port container operations (100% in China) and high-precision receiver core components in the surveying and mapping industry (over 90% in the domestic market). The company's focus on these specialized markets highlights the importance of a targeted sales strategy.

The evolution of these channels includes strategic acquisitions, such as the purchase of Shenzhen Tianli Automotive Electronics Technology Co., Ltd. for approximately CNY 250 million in March 2025, which strengthens the in-vehicle antenna capabilities and expands the automotive electronics segment. This move indicates a drive towards deeper integration within specific industry verticals. Furthermore, BDStar utilizes its subsidiaries, such as Unicore Communications Inc. and Harxon Corporation, to reach specialized markets for chips, modules, boards, and antennas. For more insights into the competition, explore the Competitors Landscape of Beijing BDStar Navigation.

Direct sales teams are key for engaging with large industrial clients, government entities, and military applications. This channel allows for customized solutions and direct technical support, which is crucial for high-precision products. BDStar's strong market share in areas like port container operations demonstrates the effectiveness of this approach.

BDStar leverages strategic partnerships to expand its market reach. The long-term partnership with NovAtel, a leading global GNSS company, highlights the importance of partner retailers and exclusive distribution deals. These collaborations are essential for reaching a wider audience and enhancing brand awareness.

Subsidiaries like Unicore Communications Inc. and Harxon Corporation help BDStar reach specialized markets. Acquisitions, such as Shenzhen Tianli Automotive Electronics Technology Co., Ltd., strengthen specific segments like in-vehicle antennas. These moves support the company's growth and market penetration.

The company focuses on both domestic and international markets. The Chinese market is a key area, with significant market share in various sectors. International expansion is supported by partnerships and specialized distribution networks. This diversified approach supports sustainable growth.

BDStar's sales strategy combines direct sales with strategic partnerships and a focus on both domestic and international markets. The company uses direct sales teams for large clients and government entities, while partnerships expand market reach. Acquisitions and subsidiaries support specialized markets.

- Direct Sales: Targeting large industrial clients and government entities.

- Strategic Partnerships: Collaborating with key players like NovAtel.

- Subsidiaries and Acquisitions: Utilizing Unicore and Harxon, and acquiring companies to expand capabilities.

- Market Focus: Strong presence in the Chinese market and international expansion.

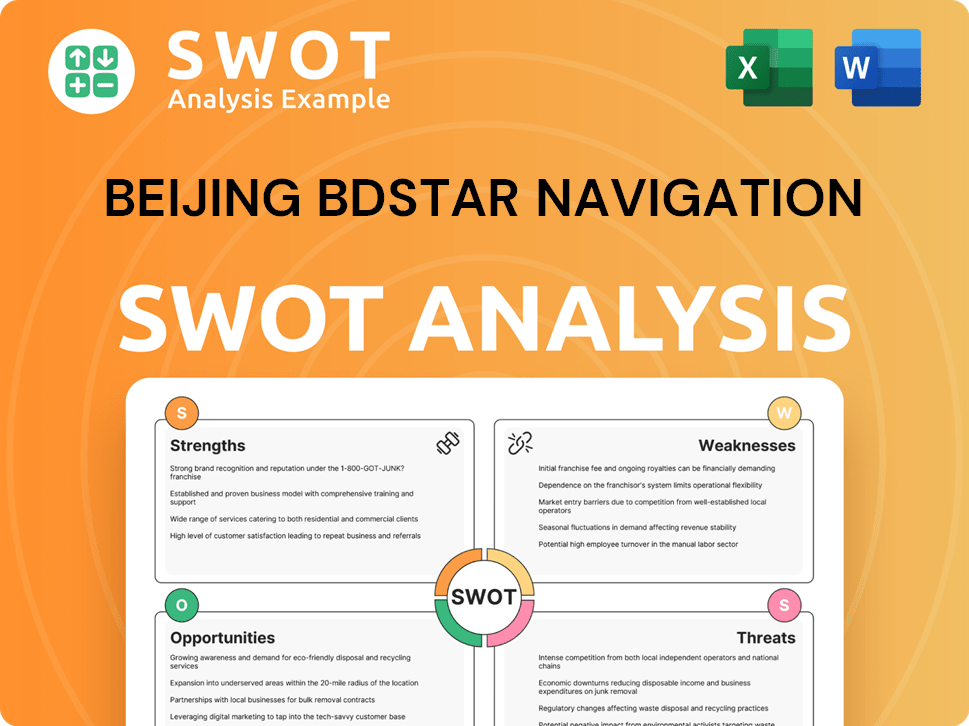

Beijing BDStar Navigation SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Beijing BDStar Navigation Use?

The marketing tactics of Beijing BDStar, a navigation company, are geared towards building awareness and driving sales within specialized industries. Given the technical nature of its products, including GNSS chips and solutions, content marketing and industry-specific events are likely central to their strategy. This approach helps BDStar engage directly with key stakeholders and potential clients.

BDStar's strategy involves a blend of digital and traditional marketing. The company uses its website and news releases to disseminate information about product launches, such as the Unicore UM981 and UM62X series automotive-grade integrated navigation modules, which were released in 2025. This indicates a focus on data-driven marketing and customer segmentation to tailor messages for different market segments.

The company's participation in industry events, such as the 2024 Chinese Global Positioning and Navigation Society (CPGNSS) Forum and INTERGEO 2024, highlights its commitment to thought leadership. These events provide platforms to showcase innovations in PNT technology and the 'Intelligent Location Digital Base' (iLDB) concept. The evolution of their marketing mix likely involves continuous adaptation to industry shifts, with a strong focus on demonstrating the practical applications of their high-precision GNSS solutions.

BDStar likely uses content marketing to educate and engage potential customers. This includes technical articles, white papers, and case studies demonstrating the value of their products. Content marketing helps establish BDStar as a thought leader in GNSS technology.

Participation in industry-specific events is a key tactic. Events like the CPGNSS Forum and INTERGEO provide opportunities for direct engagement. These events allow BDStar to showcase their latest products and network with industry professionals.

BDStar leverages digital marketing through its website and news releases. These platforms are used to announce product launches and share company updates. This approach enables targeted communication with specific customer segments.

BDStar segments its marketing efforts to address different customer needs. The company’s diverse product lines, serving industrial, automotive, and consumer applications, require tailored messaging. This ensures that marketing efforts are relevant and effective for each segment.

The company uses a data-driven approach in its marketing strategy. The 'Cloud+IC' integration in their iLDB strategy suggests leveraging data for enhanced service delivery. This approach helps to refine marketing messages and improve customer engagement.

BDStar's product launches, such as the UM981 and UM62X series, are key marketing moments. These launches are promoted through the company's website and news releases. These announcements are crucial for informing customers about new product capabilities.

BDStar's marketing strategy focuses on content creation, event participation, and digital communication. The company's approach is tailored to the technical nature of its products and the needs of its target audience. For more information, you can read a Brief History of Beijing BDStar Navigation.

- Content Marketing: Creating technical content to educate customers.

- Event Participation: Showcasing products at industry events.

- Digital Communication: Using websites and news releases for product announcements.

- Customer Segmentation: Tailoring marketing messages for different segments.

- Data-Driven Marketing: Leveraging data for improved service delivery.

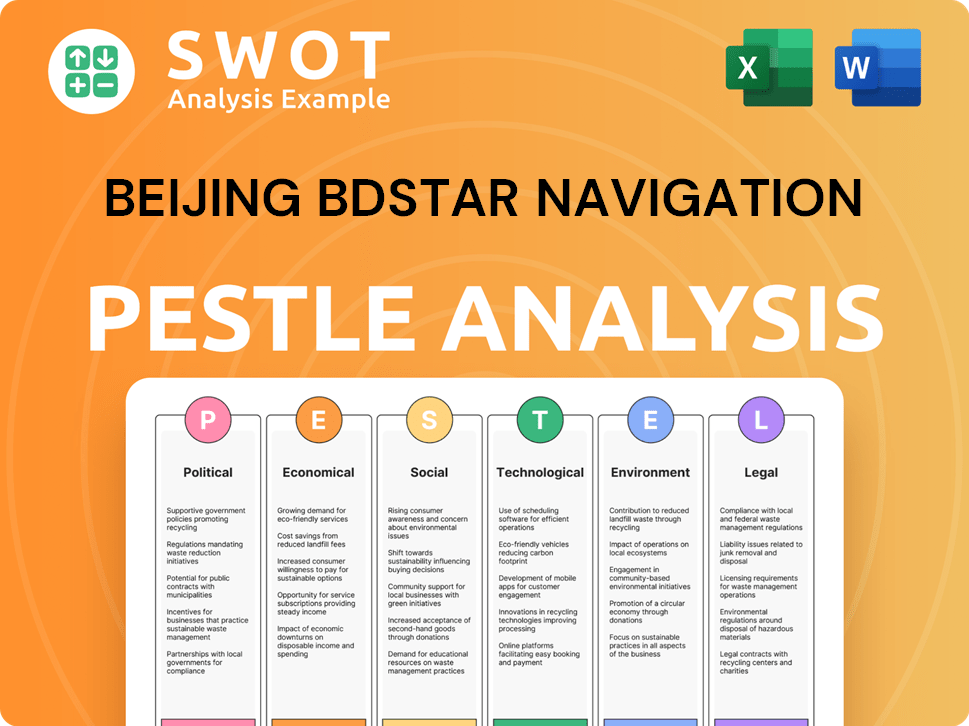

Beijing BDStar Navigation PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Beijing BDStar Navigation Positioned in the Market?

Beijing BDStar positions itself as a leader in the satellite navigation and positioning industry. The company emphasizes innovation, high-precision technology, and comprehensive solutions. Its core message focuses on providing 'excellent products, solutions and services for global users'. This strategy is evident across its three main business sectors: GNSS Chips & Data Services, GNSS Antennas, and Ceramic Components.

This brand positioning is reinforced by BDStar's significant market share in niche segments. For example, it holds a 100% market share in mechanical control for port container operations in China. Moreover, it has over 90% of the domestic market for high-precision receiver core components in the surveying and mapping industry. This strong market presence underscores the company's established position.

BDStar's brand differentiation stems from its deep expertise in GNSS applications and its focus on the BeiDou Navigation Satellite System. The company is committed to developing foundational products like chips, modules, and boards. This commitment helps BDStar cater to industrial, automotive, and consumer sectors. Its solutions offer precision, reliability, and advanced capabilities for applications like autonomous driving and IoT.

BDStar is recognized as a leading Navigation company. Its strong market share in key segments highlights its dominance. This is further supported by its focus on technological advancements and comprehensive solutions.

The company's core message centers on providing 'excellent products, solutions and services for global users'. This promise is delivered through its diverse product portfolio and commitment to quality. This message is consistent across all its business sectors.

BDStar targets industrial, automotive, and consumer sectors. It focuses on providing high-precision and reliable GNSS technology solutions. These solutions are designed for applications such as autonomous driving and IoT.

The company projects a professional, technologically advanced, and authoritative image. It uses consistent visual identity and tone of voice across its communications. Participation in industry forums like INTERGEO and CPGNSS reinforces this image.

BDStar's brand consistency is maintained through its unified business sectors and a clear focus on its core competencies in satellite navigation technology. The company's sustained growth and strategic acquisitions, such as Shenzhen Tianli Automotive Electronics Technology Co., Ltd. in 2025, further strengthen its market position. For a deeper dive into the company's strategic initiatives, consider reading about the Growth Strategy of Beijing BDStar Navigation.

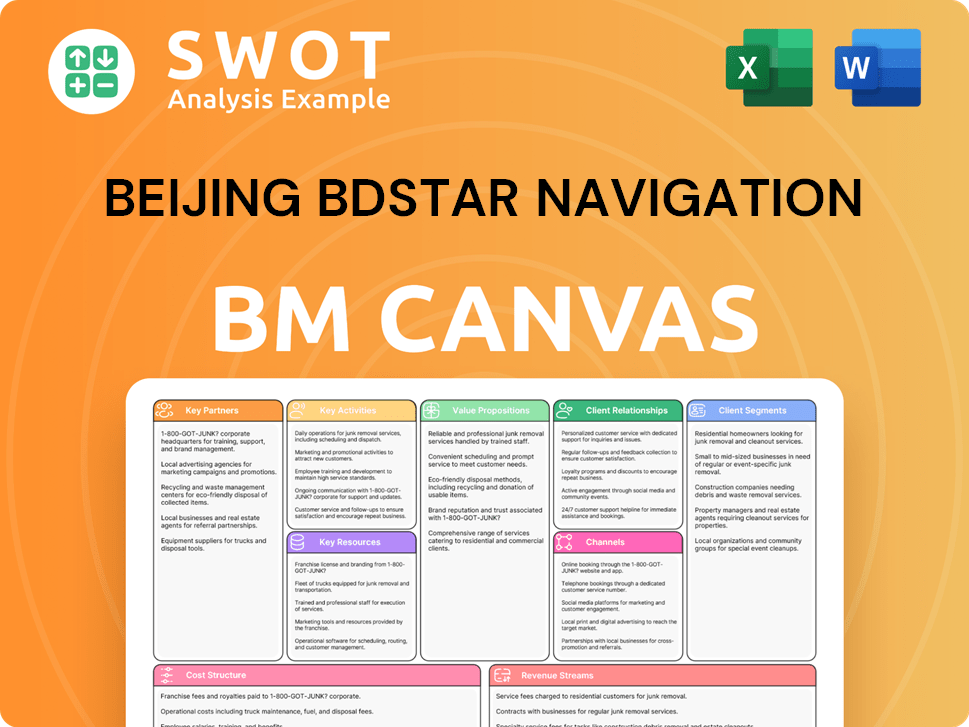

Beijing BDStar Navigation Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Beijing BDStar Navigation’s Most Notable Campaigns?

The sales and marketing strategy of Beijing BDStar Navigation Company, a leading navigation company, revolves around key campaigns designed to boost its market presence and drive growth. These campaigns focus on promoting the company's cutting-edge GNSS technology and expanding its reach within the Chinese market and beyond. The approach includes product-specific initiatives, industry event participation, and strategic partnerships to enhance brand awareness and customer acquisition.

One of the primary focuses of BDStar sales strategy is the automotive sector, particularly in the areas of intelligent driving and intelligent cockpits. BDStar marketing strategy includes continuous innovation and promotion of its high-precision GNSS modules tailored for these applications. By securing significant projects and achieving mass production milestones, BDStar demonstrates its commitment to providing reliable and advanced GNSS solutions, solidifying its position in the rapidly evolving autonomous driving market.

BDStar also actively participates in and sponsors key industry events to showcase its innovative PNT technology. These events provide a platform to engage with experts, potential partners, and customers. The company aims to boost brand visibility, establish credibility, and generate leads through direct interaction, contributing to the overall growth of the Chinese satellite navigation industry.

The company actively promotes its high-precision GNSS modules, particularly for the automotive sector. This includes modules for intelligent driving and intelligent cockpits. A successful example is the UM62X series, which started mass production for a joint venture auto brand in January 2025.

BDStar actively participates in key industry events such as the 2024 CPGNSS Forum and INTERGEO 2024. The company showcases its innovative PNT technology and its 'Intelligent Location Digital Base' (iLDB) concept. These events boost brand visibility and generate leads.

BDStar focuses on strategic partnerships to enhance market reach and customer acquisition. Collaborations with automotive brands and technology providers are key to expanding its presence in the intelligent driving market. These partnerships are vital for accessing new markets.

The company highlights its full range of GNSS chips, modules, boards, and antennas. These products are targeted at industrial, automotive, and consumer applications. This broad product portfolio is crucial for a diverse customer base.

The Chinese satellite navigation industry experienced significant growth, with a total output value of $79.9 billion in 2024. BDStar's strategic engagements, including product promotions and event participations, contribute positively to this growth. The company's focus on the automotive sector and intelligent driving positions it well for future expansion.

- The UM62X series automotive-grade integrated navigation modules passed final qualification and commenced mass production in January 2025.

- BDStar secured a significant project for intelligent driving in November 2024.

- The company's participation in industry events aims to boost brand awareness and generate leads.

- The total output value of the Chinese satellite navigation industry was $79.9 billion in 2024.

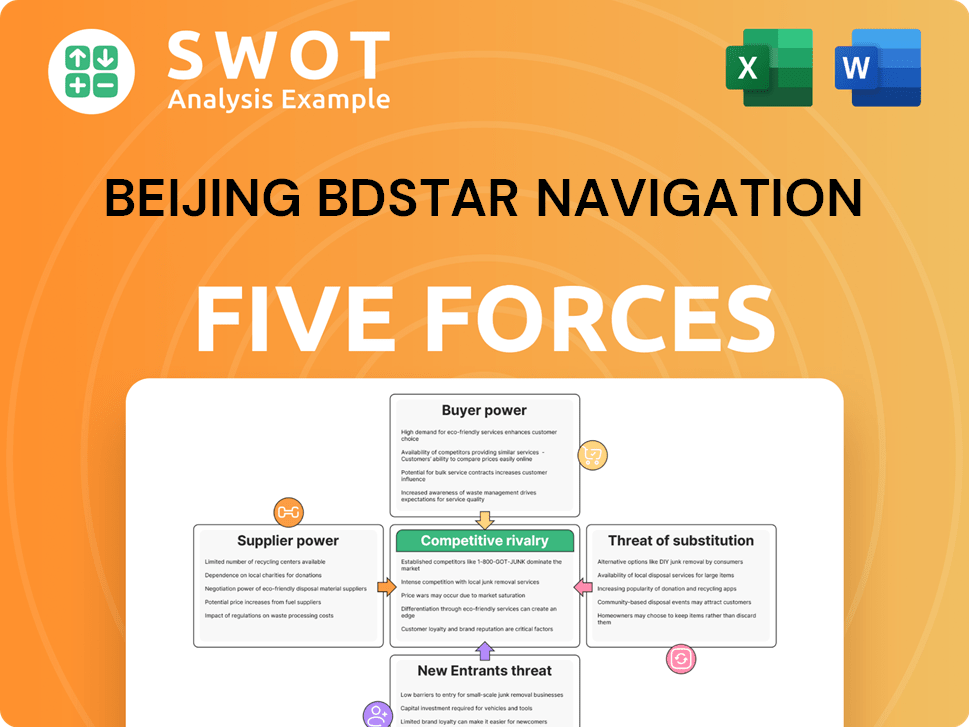

Beijing BDStar Navigation Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Beijing BDStar Navigation Company?

- What is Competitive Landscape of Beijing BDStar Navigation Company?

- What is Growth Strategy and Future Prospects of Beijing BDStar Navigation Company?

- How Does Beijing BDStar Navigation Company Work?

- What is Brief History of Beijing BDStar Navigation Company?

- Who Owns Beijing BDStar Navigation Company?

- What is Customer Demographics and Target Market of Beijing BDStar Navigation Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.