Beijing BDStar Navigation Bundle

Can Beijing BDStar Navigate to Even Greater Heights?

Established in 2000, Beijing BDStar Navigation Co., Ltd. has become a pivotal force in the satellite navigation arena. From its early partnership with NovAtel to its current status as a global group, BDStar has consistently demonstrated strategic foresight. This Beijing BDStar Navigation SWOT Analysis provides a deeper dive into the company's strengths and opportunities.

This exploration of BDStar Navigation delves into its robust Growth Strategy, examining how it leverages technological advancements and strategic partnerships to maintain its leading position. We'll analyze the company's expansion plans, dissecting its financial performance and competitive landscape within the dynamic GNSS and Satellite Navigation industry. Understanding the future prospects of Beijing BDStar requires a close look at its revenue streams and how it adapts to evolving industry trends.

How Is Beijing BDStar Navigation Expanding Its Reach?

Beijing BDStar Navigation is actively pursuing expansion initiatives to broaden its market reach and diversify its revenue streams. This strategic approach is crucial for sustained growth in the competitive satellite navigation and GNSS markets. The company's focus on innovation and strategic acquisitions reflects its commitment to staying ahead in the rapidly evolving technology landscape.

The company's expansion strategy includes both organic growth and strategic acquisitions. These efforts are designed to strengthen its position in key sectors, such as intelligent automotive, and to capitalize on emerging opportunities in the global positioning market. This comprehensive approach is vital for achieving long-term financial performance and increasing its market share.

A significant move in May 2025 was the acquisition of a 51% stake in Shenzhen Tianli Automotive Electronics Technology Co., Ltd. for approximately CNY 250 million. This acquisition aims to bolster its in-vehicle antenna capabilities, aligning with the company's focus on the intelligent automotive sector. This strategic investment demonstrates the company's commitment to expanding its presence in the automotive market.

In March 2025, Unicore, a BDStar subsidiary, launched the UM981 series of all-constellation, multi-frequency, RTK/INS integrated high-precision positioning modules. This launch combines GNSS and inertial navigation systems. The UM62X series automotive-grade integrated navigation modules also commenced mass production in January 2025.

Unicore's automotive-grade high-precision positioning modules secured a significant project for intelligent driving in November 2024. BDStar's presence at INTERGEO 2024 showcased its full range of GNSS products. The company also launched its Global High-Precision Positioning Service product series in September 2024.

BDStar Navigation is actively seeking strategic partnerships to enhance its market position and expand its technological capabilities. These collaborations are essential for entering new markets and developing innovative solutions. The company's focus on partnerships is a key element of its growth strategy.

BDStar is increasing its international presence through participation in global exhibitions and strategic product launches. This strategy aims to increase its visibility in the global market. The company is focused on expanding its reach to new customers and markets.

These initiatives are part of a broader strategy aimed at increasing BDStar Navigation's market share and ensuring long-term financial performance. For more information on the company's target market, consider reading about the Target Market of Beijing BDStar Navigation. The company's focus on innovation and strategic expansion is crucial for its future growth prospects.

BDStar Navigation's expansion strategies include strategic acquisitions, product line expansion, and international market penetration. The acquisition of Shenzhen Tianli Automotive Electronics Technology Co., Ltd. is a prime example of the company's commitment to the automotive sector. The launch of new product series and participation in international exhibitions further highlight the company's growth initiatives.

- Acquisition of Shenzhen Tianli Automotive Electronics Technology Co., Ltd. for CNY 250 million.

- Launch of UM981 series of high-precision positioning modules.

- Commencement of mass production of UM62X series automotive-grade modules.

- Participation in INTERGEO 2024 and launch of Global High-Precision Positioning Service.

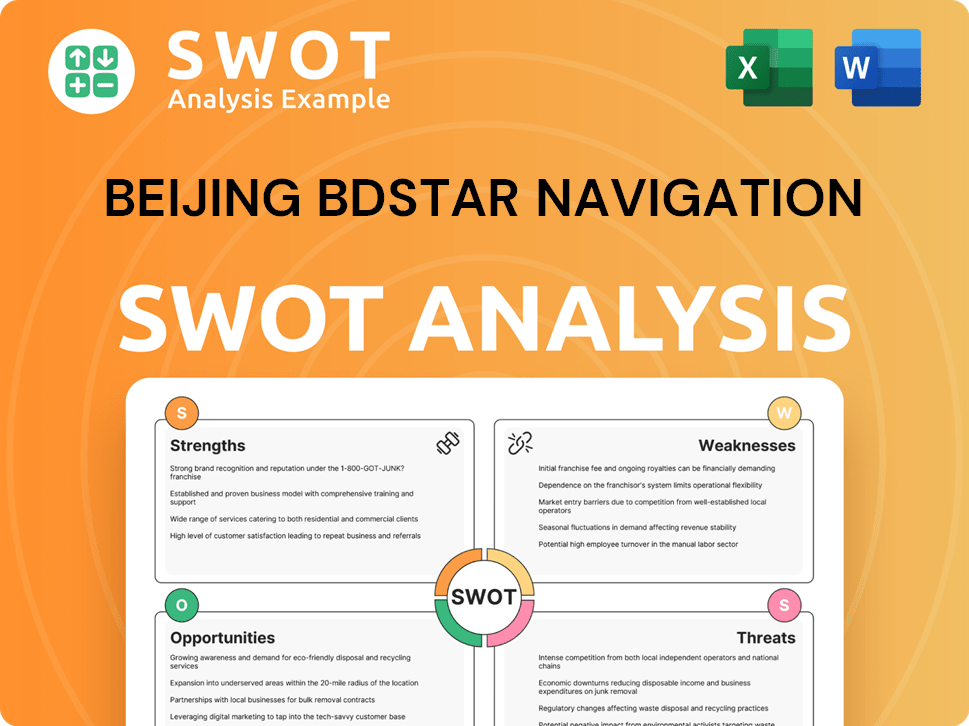

Beijing BDStar Navigation SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Beijing BDStar Navigation Invest in Innovation?

Beijing BDStar Navigation (BDStar) prioritizes innovation and technology to drive its growth strategy. The company focuses heavily on research and development, applying cutting-edge technologies to its products and services. This approach is central to its mission of promoting digital transformation across various sectors.

BDStar's 'Cloud+IC' advanced positioning platform is a key component of its 'GNSS+' ecosystem. This initiative aims to foster digital transformation. The launch of its cloud-chip integrated high-precision positioning commercial service in November 2024 highlights this commitment.

The cloud-chip integration model significantly improves the robustness of NRTK and PPP-RTK services. This leads to enhanced positioning accuracy and stability, especially during periods of high ionospheric activity. This technological advancement is crucial for applications requiring precise and reliable location data.

BDStar's subsidiary, Unicore, is a key player in product development. Unicore introduced the UM981 series all-constellation, multi-frequency, high-precision RTK/INS integrated positioning modules in March 2025. This integration combines GNSS and inertial navigation technologies.

In January 2025, Unicore began mass production of its UM62X series automotive-grade integrated navigation modules. These modules are designed for intelligent cockpits. This demonstrates BDStar's focus on the automotive sector.

BDStar concentrates on high-precision positioning, autonomous driving, and IoT applications. These areas are crucial for future growth. The company's strategic focus aligns with emerging industry trends.

BDStar actively participates in industry forums. The company engages with stakeholders to share insights and discuss industry advancements. This participation helps shape its strategic direction.

At the 2024 Chinese Global Positioning and Navigation Society (CPGNSS) Forum in July 2024, BDStar's vice president, Huang Lei, discussed building an 'Intelligent Location Digital Base' (iLDB). This initiative aims to empower new quality productivity.

BDStar's commitment to innovation is reflected in its brand recognition. The company was ranked among China's Top 500 Brands in September 2024. This recognition highlights its market position.

BDStar's technology advancements and strategic initiatives position it for continued growth in the satellite navigation sector. The company's focus on innovation and its commitment to developing cutting-edge solutions are key to its future success. For more insights, consider reading about the Mission, Vision & Core Values of Beijing BDStar Navigation.

BDStar's technology strategy centers around GNSS, high-precision positioning, and the integration of various technologies. The company's products and services cater to diverse applications.

- GNSS Technology: BDStar leverages GNSS technology to provide accurate and reliable positioning solutions.

- High-Precision Positioning: The company focuses on developing high-precision positioning systems for various applications.

- Autonomous Driving: BDStar's technology is used in autonomous driving systems, enhancing safety and efficiency.

- IoT Applications: BDStar's solutions support IoT applications, enabling connectivity and data-driven insights.

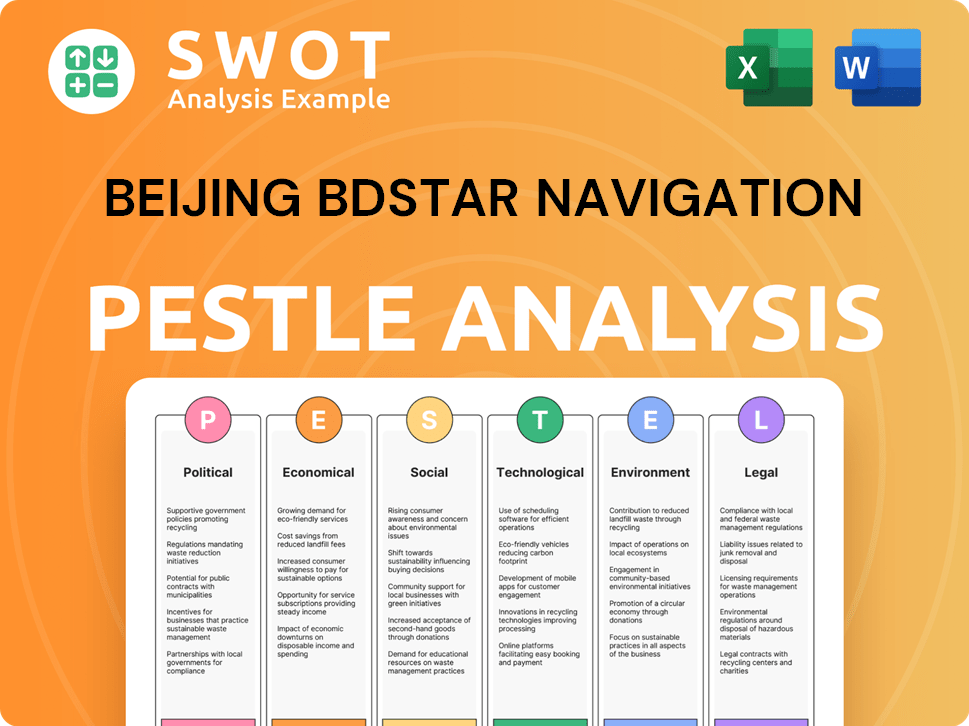

Beijing BDStar Navigation PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Beijing BDStar Navigation’s Growth Forecast?

The financial performance of Beijing BDStar Navigation in 2024 reflects a challenging period for the company. The firm experienced a significant downturn, with a net loss reported for the fiscal year. This shift from profitability to a loss position indicates operational and market pressures that the company is currently navigating. The company's financial health is a key factor for investors and stakeholders.

Revenue figures for FY 2024 also showed a substantial decrease compared to the previous year. This decline in revenue, coupled with the net loss, highlights the need for strategic adjustments to improve financial outcomes. The company's ability to reverse this trend will be crucial for its long-term sustainability and growth. Understanding the dynamics of the Brief History of Beijing BDStar Navigation is crucial.

Despite the recent financial setbacks, the company's future prospects are tied to its strategic initiatives. Investments in high-growth sectors and employee stock ownership plans are designed to drive future revenue and profitability. The company's focus on emerging sectors such as autonomous driving and IoT, along with strategic partnerships, could play a pivotal role in its future success.

In FY 2024, the company reported a net loss of CN¥349.7 million, a significant decrease from the CN¥161.2 million profit in FY 2023. Revenue for FY 2024 was CN¥1.50 billion, a 63% decrease from the previous year. The loss per share was CN¥0.65, compared to a CN¥0.31 profit in FY 2023.

For Q1 2025, the company reported revenue of CN¥0.318 billion, a year-on-year increase of 13.63%. However, a net loss attributable to shareholders of -CN¥29.6223 million was still recorded, indicating ongoing challenges in achieving profitability.

The trailing 12-month revenue as of March 31, 2025, was reported at $213 million USD. This figure provides a broader view of the company's revenue generation over a longer period, offering insights into its overall financial health.

As of May 30, 2025, the stock price was $3.86, with a market capitalization of $2.09 billion. This data point reflects investor sentiment and the market's valuation of the company.

Total assets as of March 31, 2025, were $829.064 million USD, while total debt stood at $7.770 million USD. This information is crucial for assessing the company's financial stability and its ability to meet its obligations.

The current profit margin as of December 31, 2024, was -23.34%, and the return on assets was -4.15%. These figures indicate the company's challenges in achieving profitability and efficiently utilizing its assets.

The company is focusing on emerging high-growth sectors, including autonomous driving and IoT. These investments are intended to drive future revenue and profitability. This strategic direction is crucial for long-term growth.

An employee stock ownership plan was initiated in 2025, transferring 4.97 million shares, accounting for 0.92% of the total share capital. The shares were priced at 13.51 yuan/share. This plan aims to align employee incentives with future performance.

The company operates in the GNSS and Satellite Navigation industry. Understanding industry trends and market dynamics is essential for strategic planning. The company's growth strategy must consider competitive landscape.

The company's future revenue streams are expected to come from autonomous driving and IoT. These sectors are experiencing significant growth. Diversifying revenue streams is a key aspect of the company's growth strategy.

Strategic partnerships are vital for expanding market reach and accessing new technologies. These collaborations can provide access to new markets and technologies. Partnerships are crucial for the long-term success of the company.

Analyzing the competitive landscape is essential for identifying opportunities and threats. Understanding the competitive dynamics will help the company in its growth strategy. The company needs to differentiate its product portfolio.

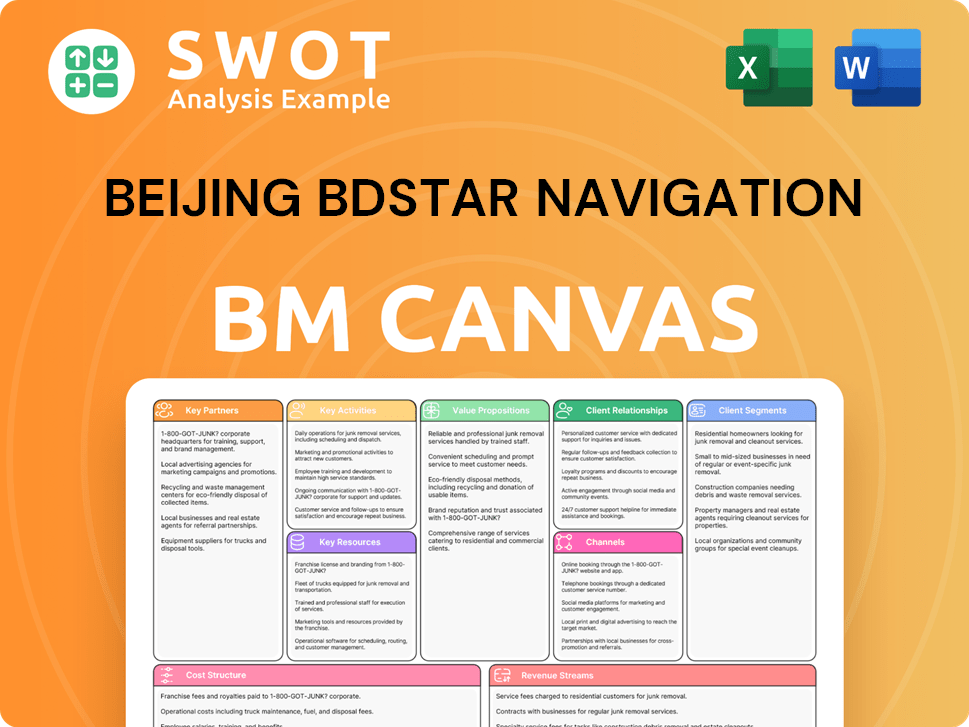

Beijing BDStar Navigation Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Beijing BDStar Navigation’s Growth?

Beijing BDStar Navigation faces several significant risks that could hinder its growth strategy. These challenges span market competition, regulatory hurdles, and operational vulnerabilities. Understanding these potential obstacles is crucial for assessing the company's future prospects.

The satellite navigation and positioning industry is highly competitive, with both domestic and international players vying for market share. Moreover, the company must navigate evolving regulatory landscapes, especially concerning technology development and usage within China. The company's financial performance also presents a risk, with recent losses potentially limiting its ability to invest in future growth initiatives.

Furthermore, supply chain disruptions and technological advancements pose ongoing threats. The company's high ESG risk rating also suggests potential challenges related to environmental, social, and governance factors, which could impact its long-term sustainability and investor appeal. These factors collectively create a complex environment for BDStar Navigation.

The Satellite Navigation market is intensely competitive, with established and emerging companies vying for market share. This competition can squeeze profit margins and demand continuous innovation in BDStar Navigation's product portfolio. Competitors may offer similar or superior products, potentially impacting BDStar's ability to expand its market presence and execute its growth strategy.

Changes in regulations, particularly in China, could significantly affect Beijing BDStar's operations. The company's addition to the U.S. Entity List in May 2024, which may restrict access to certain technologies, exemplifies this risk. Such restrictions can limit BDStar's ability to develop new products and serve certain markets, thereby impeding its growth strategy.

Supply chain issues, especially for critical components like GNSS chips and modules, could disrupt production. Dependence on external suppliers creates vulnerabilities to price fluctuations, delays, and geopolitical events. Any disruptions can negatively affect delivery timelines, increase costs, and ultimately impact BDStar Navigation's ability to meet customer demands and achieve its growth strategy.

The rapid pace of technological advancements in fields like autonomous driving and IoT presents a constant risk. BDStar Navigation must continuously innovate to stay ahead of competitors. Failure to adapt to new technologies or to anticipate shifts in market demands could render its products obsolete, thereby undermining its growth strategy and future investment.

BDStar Navigation reported a net loss of CN¥349.7 million in FY 2024 and a net loss of CN¥29.6223 million in Q1 2025. These losses can restrict the company's ability to invest in research and development, marketing, and expansion. The decline in the company's stock price, down 14.50% over the last month and 24.45% over the last six months as of May 2025, reflects investor concerns and can further limit its access to capital, affecting its growth strategy.

BDStar's high ESG Risk Rating of 32.6 (High Risk) as of February 14, 2025, highlights potential challenges related to environmental, social, and governance factors. These factors can impact investor confidence and long-term sustainability. Addressing these risks requires additional resources and strategic focus, potentially diverting from other growth strategy initiatives.

Geopolitical tensions and trade policies can significantly affect BDStar Navigation. Additional tariffs imposed by the USA could indirectly impact its business through customers. The company's antenna and chip module exports are primarily to regions outside the USA. These factors create uncertainty and may require BDStar to adapt its market strategies and supply chains to mitigate risks.

Protecting intellectual property is crucial in the technology sector. BDStar Navigation faces the risk of intellectual property infringement, which could lead to financial losses and reputational damage. The company must invest in robust IP protection measures to safeguard its innovations and maintain its competitive edge in the Satellite Navigation market. This risk can affect BDStar's long-term growth strategy.

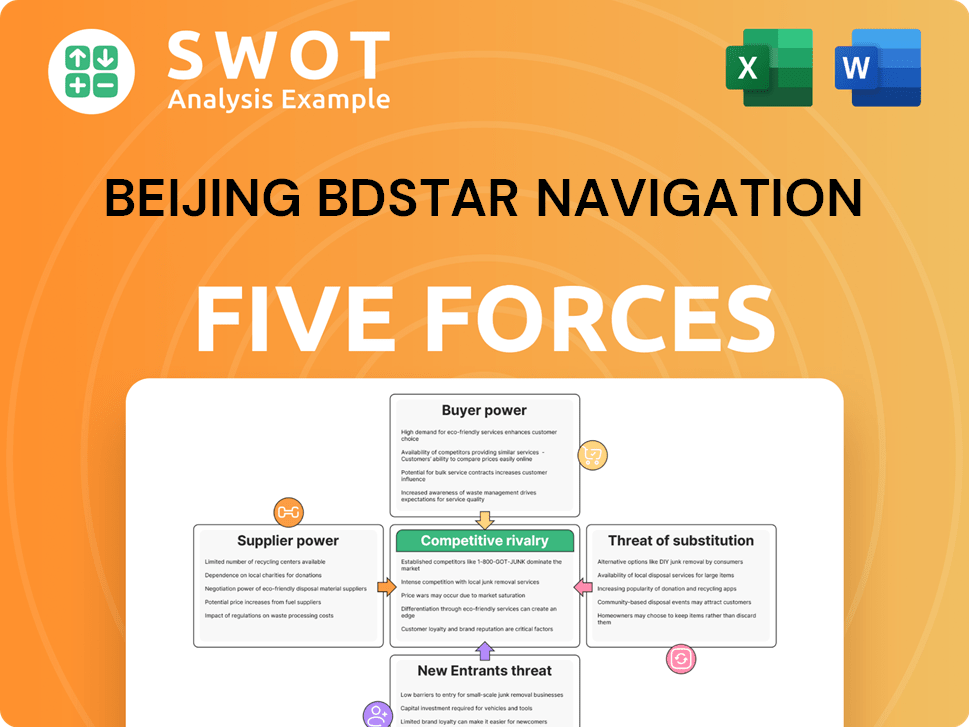

Beijing BDStar Navigation Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Beijing BDStar Navigation Company?

- What is Competitive Landscape of Beijing BDStar Navigation Company?

- How Does Beijing BDStar Navigation Company Work?

- What is Sales and Marketing Strategy of Beijing BDStar Navigation Company?

- What is Brief History of Beijing BDStar Navigation Company?

- Who Owns Beijing BDStar Navigation Company?

- What is Customer Demographics and Target Market of Beijing BDStar Navigation Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.