Etihad Airways Bundle

How Does Etihad Airways Soar Above the Competition?

Etihad Airways, the UAE's national airline, isn't just about flying; it's a global connector known for its premium services and strategic reach. Its modern fleet and expansive network, linking Abu Dhabi to destinations worldwide, make it a key player in international air travel. Understanding Etihad's operations is vital for anyone interested in the dynamics of the global aviation industry.

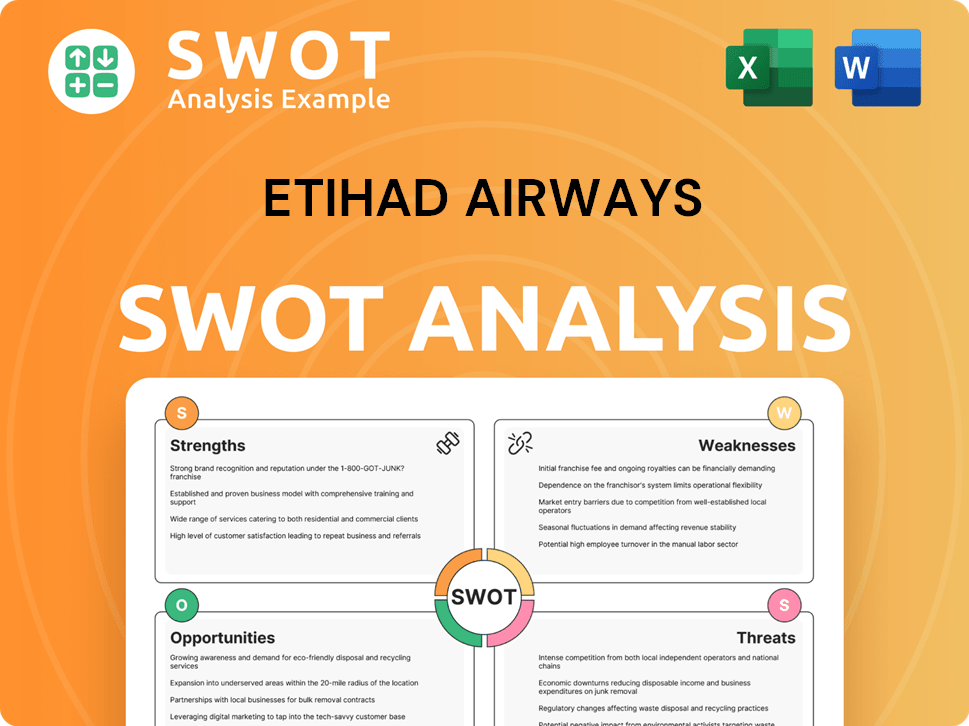

From individual investors to aviation analysts, the inner workings of Etihad Airways offer a wealth of insights. Analyzing its Etihad Airways SWOT Analysis can reveal the airline's strengths, weaknesses, opportunities, and threats, providing a comprehensive view of its strategic positioning. Delving into its airline operations, including its Abu Dhabi hub and extensive routes, is essential for grasping the complexities of the UAE aviation sector and its broader impact on the global economy. Exploring Etihad's business model helps understand its resilience and adaptability in a competitive market, covering everything from ticket booking to customer service.

What Are the Key Operations Driving Etihad Airways’s Success?

The core operations of Etihad Airways revolve around providing comprehensive air transportation services. This includes scheduled passenger flights, premium travel experiences, and cargo services, all supported by a modern fleet. The airline focuses on a premium travel experience, incorporating Arabian hospitality and advanced in-flight amenities, setting it apart in the competitive airline operations landscape.

The airline's value proposition centers on offering a differentiated travel experience. This is achieved through operational efficiency, customer-centric services, and a strategic hub in Abu Dhabi. This approach allows Etihad to provide competitive connections between East and West, attracting discerning travelers and freight forwarders.

Operational processes are meticulously managed, encompassing advanced fleet maintenance, sophisticated route planning, and network optimization. Etihad Airways utilizes a combination of direct sales channels and indirect channels through global distribution systems and travel agencies to reach its customers.

Etihad operates a diverse fleet, including Boeing 787 Dreamliners and Airbus A350s, enabling efficient long-haul and regional operations. The airline's network strategically connects Abu Dhabi with destinations worldwide. This wide reach is crucial for its business model, allowing it to serve a global customer base.

Customer service is a key focus, from booking to post-flight support. The airline emphasizes a premium travel experience with Arabian hospitality and state-of-the-art in-flight amenities. This commitment aims to enhance passenger comfort and build brand loyalty.

Etihad's cargo division is a significant part of its operations, facilitating the delivery of goods globally. This division contributes to the airline's revenue streams and supports its overall network. The cargo operations are designed to be reliable and efficient.

Strategic partnerships with aircraft manufacturers like Boeing and Airbus are essential. These partnerships ensure access to modern aircraft and support the airline's operational efficiency. These relationships are critical for maintaining a competitive edge in the UAE aviation sector.

The airline's operational efficiency and customer-centric approach translate into benefits such as enhanced passenger comfort and reliable cargo delivery. Etihad Airways differentiates itself through its premium brand image, attracting discerning travelers and freight forwarders.

- Fleet Management: Efficient fleet maintenance and strategic route planning.

- Customer Service: Focus on customer satisfaction at every touchpoint.

- Network Optimization: Maximizing connectivity through the Abu Dhabi hub.

- Revenue Streams: Diversified through passenger and cargo services.

Etihad Airways SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Etihad Airways Make Money?

Etihad Airways, a prominent player in the airline industry, generates revenue through diverse streams, primarily focusing on passenger and cargo services. As an Abu Dhabi airline, its business model is designed to maximize profitability through strategic pricing and ancillary services. The airline's financial performance is closely tied to its ability to optimize these revenue streams.

The airline's revenue model is multifaceted, incorporating various strategies to enhance profitability. Understanding the intricacies of Etihad's revenue streams provides insights into its overall financial health and strategic direction. The UAE aviation sector, in which Etihad operates, is highly competitive, necessitating continuous innovation in revenue generation.

Etihad Airways' passenger services are a major source of income, encompassing ticket sales across different classes, ancillary services, and its loyalty program, Etihad Guest. In 2023, the airline saw a significant increase in passenger numbers, reaching 14 million, supported by a 30% rise in revenue passenger kilometers (RPKs). Furthermore, cargo services, facilitated by Etihad Cargo, contribute substantially to its revenue. The airline's total revenue for 2023 reached 5.5 billion USD, reflecting strong performance across both passenger and cargo operations.

Etihad employs several innovative monetization strategies to boost its revenue. These include tiered pricing for different travel classes, bundled services for premium offerings, and dynamic pricing models based on demand and seasonality. The airline also uses its Etihad Holidays division to cross-sell travel packages, combining flights with hotel stays and other services. The airline has been exploring new avenues, such as its recent launch of a new route to Al Qassim, Saudi Arabia, in Spring 2024, to diversify its revenue mix by tapping into new regional markets and increasing connectivity within the Middle East.

- Tiered Pricing: Offers various fare options for Economy, Business, and First Class.

- Ancillary Services: Generates revenue from baggage fees, seat selection, and in-flight purchases.

- Loyalty Program: Etihad Guest rewards frequent flyers, encouraging repeat business.

- Dynamic Pricing: Adjusts ticket prices based on demand and seasonality.

- Cross-selling: Etihad Holidays combines flights with hotels and other services.

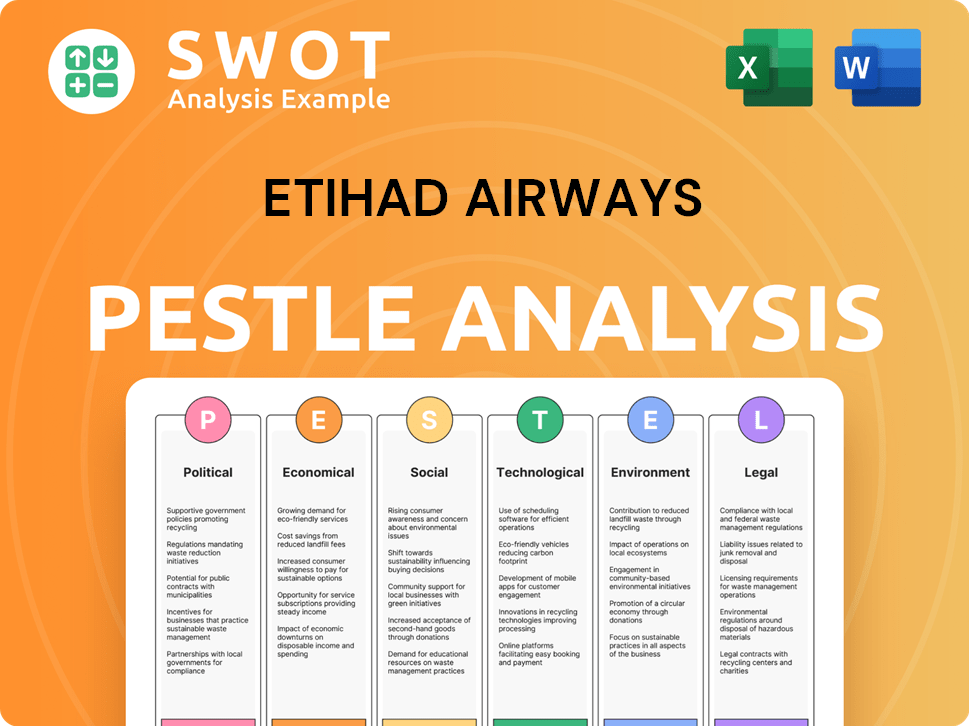

Etihad Airways PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Etihad Airways’s Business Model?

Etihad Airways, a prominent player in the global aviation industry, has navigated a complex landscape marked by significant milestones, strategic shifts, and competitive challenges. The airline's journey reflects a commitment to adapting to market dynamics and enhancing operational efficiency. Understanding these elements is crucial for grasping the airline's current standing and future prospects.

A key aspect of Etihad's evolution involves its strategic moves, particularly its restructuring program. This initiative has been instrumental in improving financial performance and adapting to the changing demands of the aviation sector. The airline's focus on operational excellence and customer experience has further shaped its trajectory, positioning it for sustainable growth.

The airline's competitive edge is bolstered by its strong brand reputation, strategic hub location in Abu Dhabi, and modern fleet. These elements, combined with its commitment to innovation and sustainability, underscore its ability to compete effectively in the global market. For a deeper dive into understanding the airline's customer base, you can explore the Target Market of Etihad Airways.

Etihad Airways has achieved several key milestones, including significant fleet expansions and route network developments. The airline has also focused on enhancing its in-flight services and customer experience. These milestones have contributed to its growth and recognition in the aviation industry.

A major strategic move was the comprehensive restructuring program, focusing on fleet optimization and operational streamlining. This involved the introduction of fuel-efficient aircraft like the Airbus A350-1000. These moves have been crucial for improving financial performance and adapting to market changes.

Etihad's competitive advantages include its strong brand reputation for luxury and service excellence. Its strategic hub in Abu Dhabi offers excellent connectivity. The airline also leverages its loyalty program, Etihad Guest, to foster customer retention and engagement.

In 2023, Etihad Airways achieved a record operating profit of 143 million USD, a significant turnaround. The airline's focus on cost management and revenue generation has driven this positive financial performance. This demonstrates the effectiveness of its strategic initiatives.

Etihad Airways has adapted to various challenges, including the COVID-19 pandemic, by focusing on cargo operations and implementing safety measures. The airline continues to invest in digital transformation and sustainability initiatives, such as expanding its SAF program in 2024. These initiatives enhance customer experience and operational efficiency, reflecting a commitment to environmental responsibility.

- The airline's fleet includes modern aircraft like the Airbus A350-1000.

- Etihad Guest loyalty program fosters customer retention.

- Focus on sustainable aviation fuel (SAF) initiatives.

- Strategic hub location in Abu Dhabi enhances connectivity.

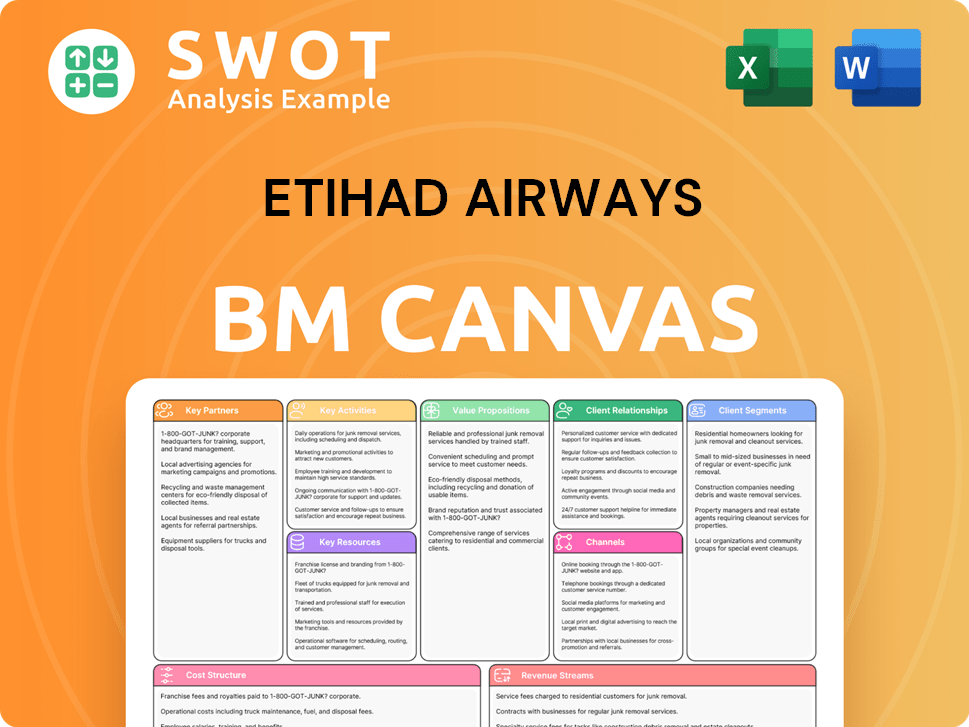

Etihad Airways Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Etihad Airways Positioning Itself for Continued Success?

Etihad Airways, a prominent player in the global aviation industry, holds a significant position, particularly among Middle Eastern carriers. Competing with major airlines like Emirates and Qatar Airways, it leverages its strong brand recognition, premium service offerings, and strategic hub in Abu Dhabi to maintain a competitive edge. This positioning is crucial for attracting customers, especially in the long-haul and luxury travel segments, with a global reach spanning major continents.

The airline's operations and revenue face several risks, including volatile fuel prices, geopolitical instability, and intense competition. Economic fluctuations and regulatory changes add further complexities. Despite these challenges, Etihad Airways is focused on sustainable growth and operational excellence, aiming to deliver a world-class travel experience.

Etihad Airways competes directly with major airlines like Emirates and Qatar Airways. Its strategic hub in Abu Dhabi and premium services contribute to its competitive standing. The airline focuses on long-haul and luxury travel, connecting key business and leisure destinations globally.

Key risks include volatile fuel prices, geopolitical instability, and intense competition. Economic conditions and regulatory changes also pose challenges. These factors can impact operations and revenues.

Etihad Airways is focused on sustaining profitability and expanding its network strategically. It plans to modernize its fleet, enhance digital capabilities, and explore new partnerships. The airline aims to leverage its premium brand and adapt to market dynamics.

The airline's strategic initiatives include fleet modernization and enhancing digital capabilities for improved customer experience. It also explores new partnerships to expand its global reach and connectivity. These strategies aim to sustain and expand revenue generation.

Etihad Airways' recent financial performance, including record profits in 2023, underpins an optimistic outlook. The airline is focused on sustained profitability and expansion in 2024 and beyond. The airline continues to focus on efficiency and customer satisfaction.

- Etihad Airways' focus on premium services and strategic hub location.

- The airline's fleet modernization and digital enhancements.

- The impact of fuel prices and geopolitical factors on operations.

- The airline's commitment to sustainable growth and operational excellence.

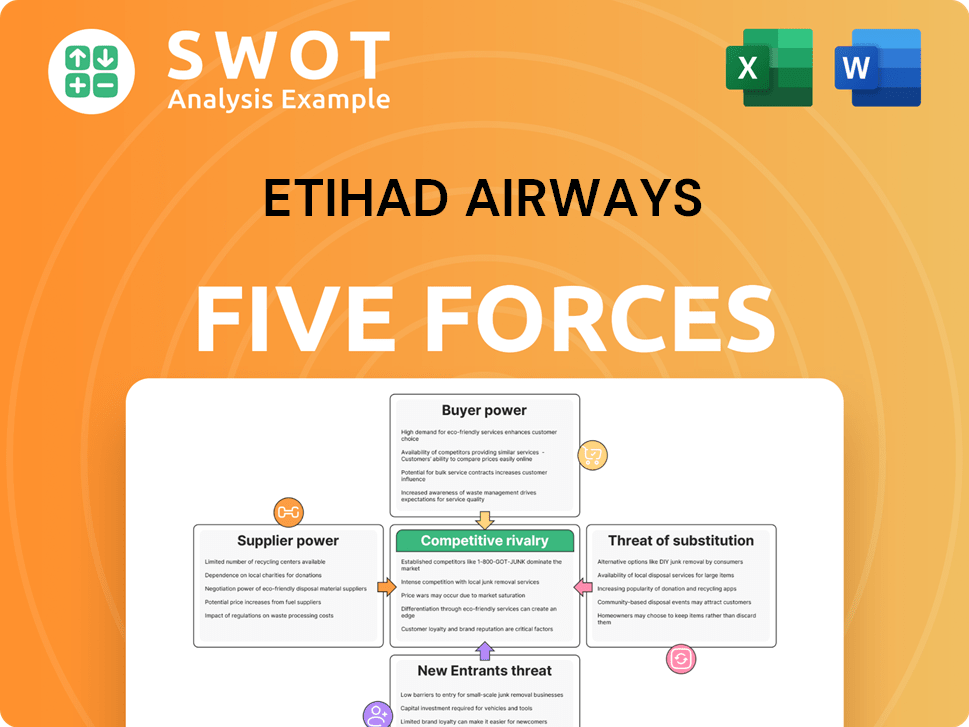

Etihad Airways Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Etihad Airways Company?

- What is Competitive Landscape of Etihad Airways Company?

- What is Growth Strategy and Future Prospects of Etihad Airways Company?

- What is Sales and Marketing Strategy of Etihad Airways Company?

- What is Brief History of Etihad Airways Company?

- Who Owns Etihad Airways Company?

- What is Customer Demographics and Target Market of Etihad Airways Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.